The Politics Behind Crypto and Digital Assets

As of today, Crypto is still seen as the “Wild Wild West.” But the world is moving towards faster payment systems. Countries all over the world are entering the crypto space to counteract inflation.

FXC Intelligence: “How will cross-border payments infrastructure change in 2025” (Prayoonrat 2025).

A talking point for Trump’s campaign was making America the “Crypto Capital of the World.” Which is not a far fetched idea. It was however, a complete 180 from the last four years of administration.

Trump speaking at the 2024 Bitcoin Conference in Nashville, Tennessee

“I will fire SEC Chairmen, Gary Gensler, day 1.”

The Securities Exchange Commission has had a long list of litigation battles between crypto exchanges and companies over whether or not the sales of crypto on exchanges count as security contracts or a commodity. This also comes with ambiguous regulation that allowed free passes for some cryptocurrencies and exchanges, while playing hardball for others, referring to the 2018 Bill Hinman speech which deemed Ethereum “not a security” without any evidence or investigation into its business.

As of Feb. 24, 2025 the SEC has dropped a number of court cases involving crypto enforcement. (Lang & Prentice Reuters 2025).

Another thing to note, was the largest fraud case involved an offshore crypto exchange, FTX, where billions of dollars were taken from crypto investors. Coincidence enough, its CEO Sam Bankman-Freid used roughly $100 million in stolen funds for the democratic party in the 2022 midterm election (Reuters 2023).

View the article showcasing each public donation made at (opensecrets.org)

Ripple CEO, Brad Garlinghouse, “The Biden Administration waged a war on Crypto.” (2024)

As of July 2023, Ripple’s (XRP) is the only digital asset that has regulatory clarity, being deemed as a “non-security” in the U.S. Court system. Now holding over 55 money-transmitter licenses in the U.S, including states like New York and Texas. Ripple has fortified its position in the digital financing industry.

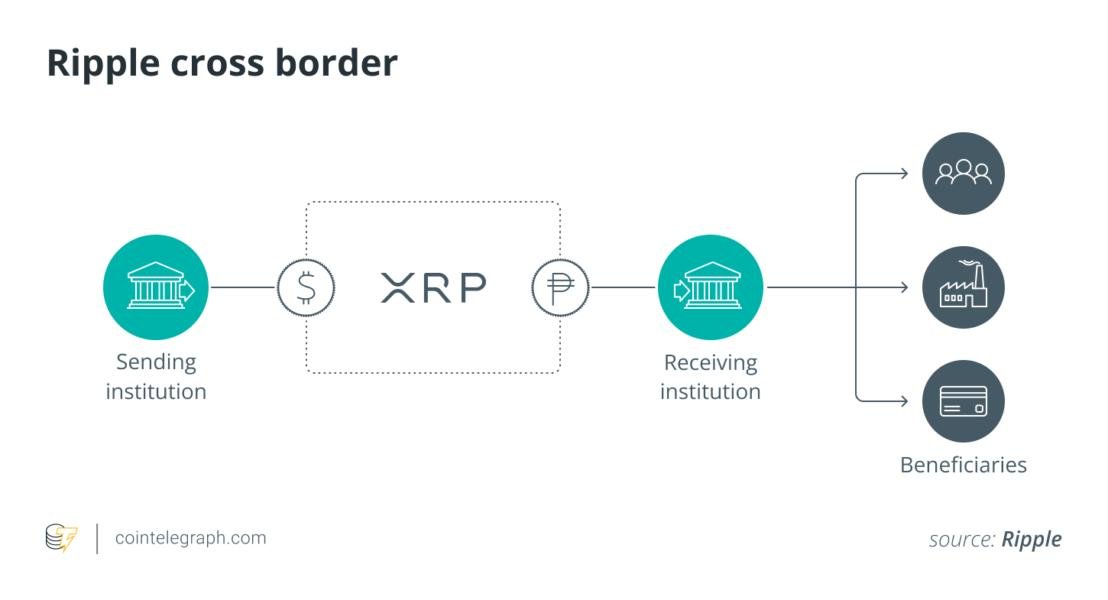

“Focusing on solving the problems between cross-border payments. Making them cheaper, faster, and more reliable” - Ripple CEO Brad Garlinghouse

Tradingview.com Cointelegraph: What are cross-border payments, and how do they work? (2023)

With the election in the books, and the start of the new “Golden Age” in America, we are seeing a difference in the crypto sentiment. We now have a pro-crypto administration, and over 200 pro-crypto congress men and women in office. We see more g7 countries acknowledging and innovating towards a financial blockchain system. Elon Musk and DOGE have proposed the idea of making all of the U.S. government transactions publicly available via blockchain network.

In President Trump’s first week of office, he put in place a Crypto Council to analyze and create clear rules of the road. With that, he also signed executive orders that created a “Sovereign Wealth Fund” and a “Reserve Stockpile of Digital Assets.” This is huge when coupled with the fact that the chairmen of The Federal Reserve, Jerome Powell, also stated that “Banks are perfectly capable of serving crypto customers.”

Not to mention companies like Blackrock and Vanguard are already offering spot Bitcoin ETF’s, which broke records for best performing ETF in its first year with $53 billion in growth. As of now Ethereum and Bitcoin are the only spot-ETFs available on market. However, as of February 13, 2025 the SEC acknowledges the filing of a Grayscale spot-XRP ETF, and NYSE Spot-XRP ETF. More recently, Brazil’s largest bank is the first to approve and list a spot-XRP ETF (Cointelegraph 2025).

If the NYSE is able to offer tokenized assets and crypto in the future, and America is the largest economy. Wouldn’t that make America the “Crypto Capital of the World” by nature?