Current Financial Problems

When exploring potential use cases for Crypto and Digital Assets, it is hard to ignore major concerns in the current financial system. On-demand liquidity (ODL) and time constraints cause friction for cross-border payments.

Transferring money today is as simple as a couple taps on your mobile device, utilizing new instant payment networks (highways) like Cashapp, Paypal, or Zelle. However, transferring that value is not as instant as it may seem. The movement of payments (cars) can be virtually instantaneous. However the problem is the exit ramps, taking payments off network and into accounts.

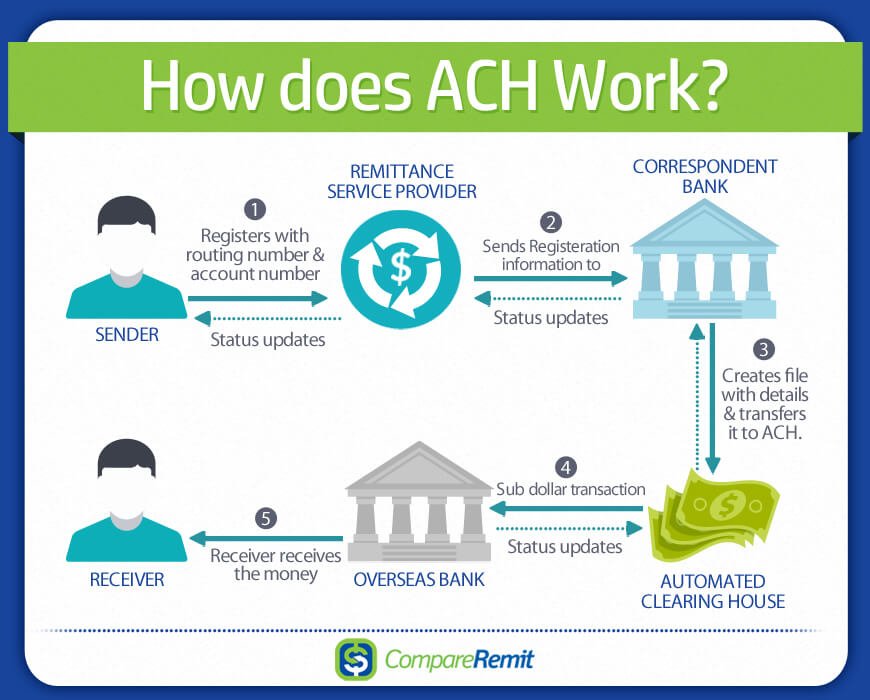

The settlement process can take 2-3 business days, or up to five days for international transactions. With delay, there is usually a fee you can bypass the wait time for. The problem is the validation of funds being transferred. We can tie this to the system of correspondent banking.

In order to validate cross-border transactions, there needs to be some underlying funds that are locked to ensure the settlement. In todays financial world, these are called Nostro/Vostro Accounts. Derived from Latin, Nostro, meaning ours, is when Bank of America opens an account with the Bank of England, a corresponding foreign bank, in their native currency (British Pound). Vostro, meaning yours, is for the perspective of that foreign corresponding bank (Bank of England), holding deposits for Bank of America. These accounts fuel the settlements of cross border payments. When two banks do not hold Nostro/Vostro accounts together, they need to find one they both use, just like finding the lowest common denominator.

Bank A and Bank B do are not corresponding banks that hold Nostro/Vostro Accounts with each other. So they must bring an intermediary bank which they both hold accounts with to complete the transaction. (Roll, ISO20022 Payments, 2024).

Time is of the Essence

The settlement process can take 2-3 business days, or up to five days for international transactions. Banks and payment networks will have fees for either the sender or receiver.

“Most banks separate fees into incoming and outgoing wire transfer fees, and whether the transfer is domestic or international. Outgoing wire transfer fees range from $20-35 for domestic transfers, and $35-50 for international transfers. Incoming wire transfers may range from $0 to $16,” (Lowry “How Much are Transfer Fees?” Westernunion.com 2024).

Fees are a huge expense when we get into multi-million dollar transactions. But even with the fees, there is still a problem in the efficiency of the settlement process. How many transactions do you think occur daily?

“ACH: Understanding for Beginners” (July 2022) via paylinedata.com

The Automated Clearinghouse (ACH) can only process roughly 75 million transactions per day, operating 23 hours. The largest clearing house for USD, Clearing House Interbank Payments System (CHIPS), which can process around 500,000 transactions per day, settling roughly $1.8 trillion dollars daily (the clearinghouse.org). However, they only operate on a 21 hour day.

If money makes the world go round, then why does our banking system have weekends and off days?

Our current financial system is run off of centralized ledgers. Each bank has their own central server that stores all transactions and data, which creates a lack of efficiency in the settlement process. A decentralized system will create more exit ramps for ODL.

4irelabs.com “DLT can spare us of any central authority. Think of banks, manufacturing, real estate, voting, tax collection, etc. If we can achieve complete decentralization in any aspect, we can save time, money, and other valuable resources without compromising security” (2021).

The current transaction process is very tedious and has many steps. Adding corresponding intermediary banks to transactions can become confusing, prolong settlement times, and add security risks. It is important that we create standardization and interoperability to the finance industry, improving efficiency through the removal of intermediary banks needed in cross border transactions.

Infinicept.com “Acquiring bank vs. Issuing Bank: What’s the Difference Between the Two?” (2022).

This is where the golden nugget lies in the new financial era. What software or protocol will be the foundation of all transactions in the future? Every bank has their own computer system in which they process and track all payments. Standardization is important.

This isn’t just your bank transactions. This is creditr transactions, investments, 401k, and unlocking escrow accounts when purchasing large ticket items both domestically, and internationally.